“Give God the first fruits and He will bless the rest of the 90%.”: Salt&Light Family Night on 8 principles to teach kids about managing money

by Christine Leow // April 27, 2022, 6:22 pm

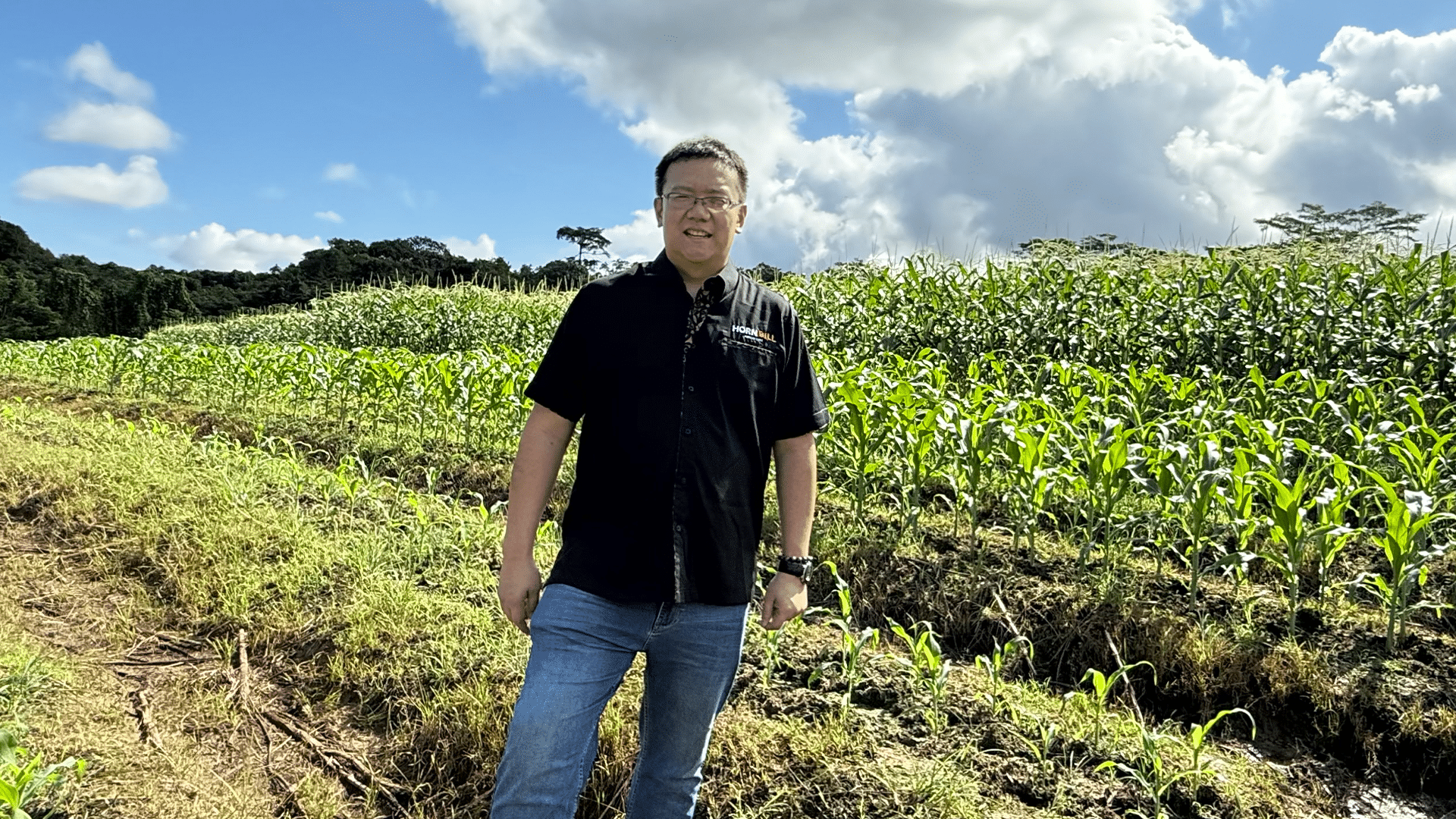

Growing up, Samuel Pei was never taught money management. In fact, it was taboo to talk about money in his family. Now, he is intentional about teaching his children to tithe, give and save. Photo courtesy of Samuel Pei.

The three panellists on Salt&Light Family Night (April 26) all came from humble backgrounds.

Samuel Pei’s father worked the graveyard shift in a garment factory while his mother worked at McDonald’s.

Watching how hard his parents had to work to put food on the table, Samuel learnt the importance of hard work. But he also wondered why his neighbours did not seem to have to work as hard but were able to have more money as well as time for their families.

“I later discovered that they were in the business world. So, they had flexibility of time to spend with the family.”

That was when Samuel purposed to run his own business when he grew up.

He chose Accounting at Nanyang Technological University (NTU) and started his own printing business with two friends in his second year of university. The friends would later also found KC Group, a retail business that today has more than 100 hair and beauty salon outlets across Singapore.

Klaudia Yeo’s father was a taxi driver and her mother worked in a jeans factory. “She ironed jeans. My mum died when I was 16 due to overwork,” said Klaudia.

“My mum died when I was 16 due to overwork.”

Her brother was only nine then. As the elder child, Klaudia was asked to quit school and go to work to supplement the family income.

“I was angry because I loved to study.”

Instead, she took on a variety of after-school jobs – at fast-food joints and factories, giving tuition – to see herself through school.

Klaudia is now a Chartered Financial Consultant and a certified ACTA trainer. In the last 25 years, she has built up a client base of more than 1,000. She also conducts talks on financial literacy in schools and churches.

Bernard Lim’s father was a police officer and the family relied on his one income. They lived in a rented home when he was growing up.

Bernard is now the CEO of Wealth Hub Pte Ltd. with more than 25 years of experience in the financial services industry. A trainer and speaker particularly on estate and legacy matters, he founded the N5Collective Conference 2021 last year. The event brought together over 30 Kingdom-minded finance experts to share about managing wealth God’s way.

But those early years of simple living would go on to shape Samuel, Klaudia and Bernard’s views on managing money.

Asher Pei with his father Samuel, who is intentional about teaching money management to all his three children. Photo courtesy of Samuel Pei.

Samuel and his 12-year-old son Asher, along with Klaudia and Bernard, were panellists on Salt&Light Family Night (April 26) to talk about teaching children to manage money God’s way.

Almost 200 viewers joined the Zoom session, many of whom were parents (close to 80%). Asked about their top concern about managing money biblically, viewers mentioned stewardship and financial wisdom.

Here are the panellists’ principles about managing money that they taught their own children.

1. Put God first

As a child, Samuel’s parents never talked to him about money.

“The idea is always: We shouldn’t talk about money at home because it’s taboo. I never knew how much my dad was earning or whether it was enough for everyone. So, growing up, I didn’t know how much things cost – how much a house cost or how much a car cost.

“The traditional mindset for money management was to work very, very hard, minimal spending, maximum frugality and hopefully you will save enough at the end of the day to have something left over.”

“I teach them to budget and through the process of budgeting, learn to always put God first.”

Now, with his own three children, Samuel is intentional about teaching money management.

“I teach them to budget and, through the process of budgeting, to learn to always put God first.

“I emphasise the principle of tithing the first fruits.”

When his oldest child, Asher, started Primary One, Samuel gave him not a daily allowance as is the practice of most parents, but a weekly one. This was so he could learn to manage a sum of money.

“I told him, ‘I give you this amount. Before you even buy your chicken rice, you give to God what He has blessed us with. This 10% is called tithing. Then, I explained to him through the Bible why we do that.

“Give God the first fruits and He will bless the rest of the 90%.”

For the Pei family, the timing of the tithing is important. The children tithe the moment they receive their allowance, in order to literally put God first.

2. Keep track of your money

Samuel then taught his children how to apportion the rest of the 90%.

The next 10% goes to a special fund that is used to buy presents to bless others, or towards birthday gifts for friends. Savings are pegged at 20%.

“I will always remember that whenever I get money, I need to tithe 10% of it.”

“This saving is parked under his untouchable fund for a rainy day. Back then, he may have thought: Why rainy day? You have a dad, it will never rain!

“We had to teach him, ‘This is for your own rainy day because I may not always be around.’”

The remaining 60% is for spending.

“It was not easy for a P1 kid to understand because you are talking about fractions and percentages. But three months down the road, he kind of got it. Then, I encouraged him to do his own calculations.”

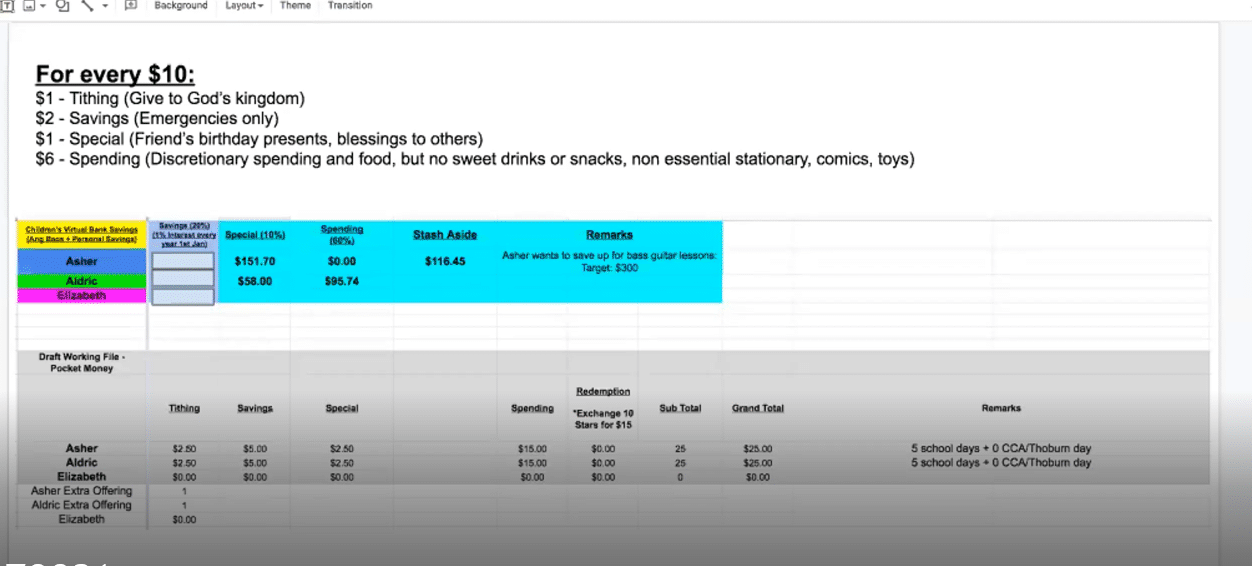

To help them keep track of the different pots of money, Samuel has a Google spreadsheet showing the various amounts.

The Google spreadsheet Samuel created to keep track of his children’s money. Screenshot from Salt&Light Family Night.

From the 60% allotted for spending, his children can decide how much they want to draw down each week. Samuel would then function like an ATM and hand them the cash. They need not withdraw the full 60%. So, during the week, if they decide they need more, they may approach him again. What they cannot do is draw out more than they have.

“No overdrafts,” said Samuel firmly.

Asher (left) appreciates the system his father Samuel taught him to apportion his pocket money. Photo courtesy of Samuel Pei.

Asher, who has been managing money in this manner for five years, finds the system “quite useful”. Now, it has become a habit for him to apportion any money that comes his way in this manner.

“They learned to compare prices even for things that they needed.”

“I will always remember that whenever I get money, whether it is by reward or even if I find $1 on the floor, I still need to tithe 10% of it, save 20% and then I put 10% into the special fund. Then, I can spend the rest.

“When I grow up, I can stick to this habit.”

To all parents, he had this to share: “Let your children be a little bit more independent. Instead of receiving pocket money daily, you can give it to them weekly.

“If they are not managing it well, teach them or give them instructions on how to manage it better.”

Bernard Lim (right) taught his children to keep a record of their spending. Photo courtesy of Bernard Lim.

When Bernard’s children were young, they had a similar tracking system so they would “know where the money goes”.

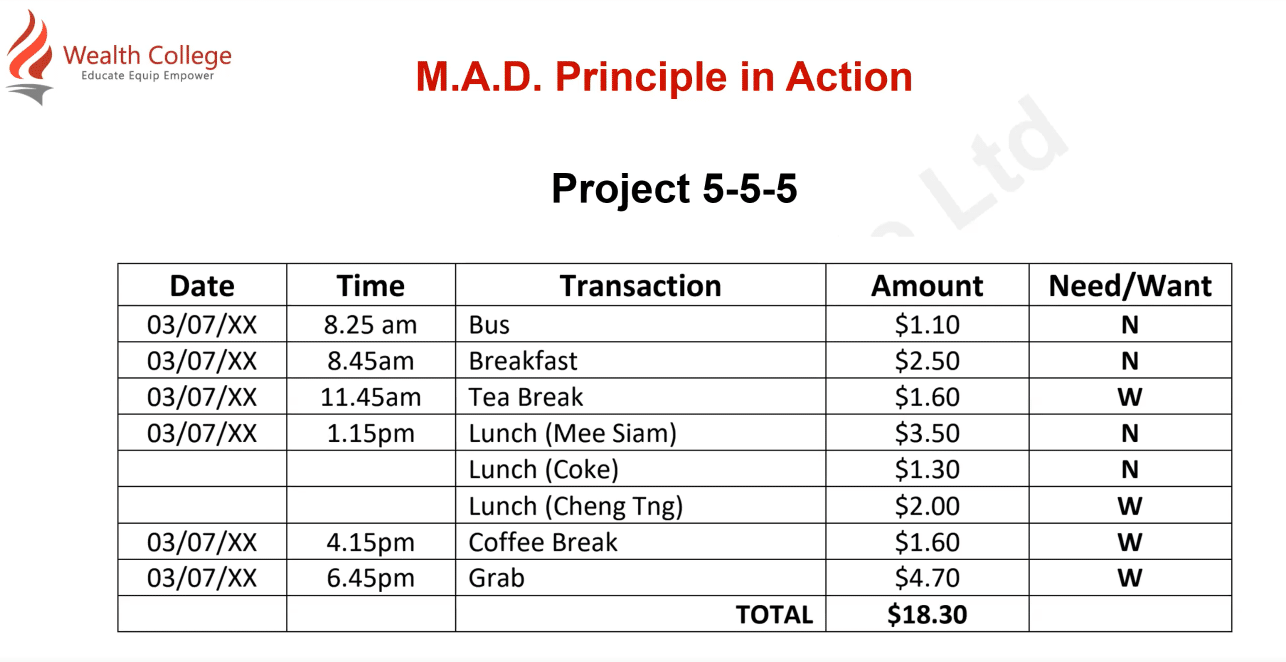

As part of exercising discipline in spending money, his children were encouraged to document how they spent their money in a 555 notebook, so named because the books have five columns to record transaction data, such as the date and amount on an item spent.

He also taught his children to compare prices.

“If you have been buying Coke for this amount, go to three different places and find out if there is a difference in price when you buy Coke.

“They learned to compare prices even for things that they needed. It was to get them to think and process their spending.”

3. Save before spending

When asked for a tip he learnt from his father that he wanted other children to know, Asher said; “Try to save before you spend.

“If you think you can save after you spend, most of the time, it won’t work out that way. You will end up spending all your money.

“Sometimes, I have to consider when I buy something from the bookshop – should I eat first or buy first? Or should I save my money?”

4. Value delayed gratification

Saving also teaches delayed gratification, something Bernard encouraged in his children.

“I know that as long as I do my part (and save), sooner or later I can also buy what I want.”

“Are they prepared to defer all the things that they want in order to get it much later?

“There are scientific proofs – the Marshmallow Experiment – that delayed gratification can help people go very far in their careers and lives.”

Delayed gratification has helped Asher stave off peer pressure. Mingling with friends who have more to spend does not faze him.

“I don’t mind that people are very rich and show off. I know that as long as I do my part (and save), sooner or later I can also buy what I want.”

5. Discern wants from needs

In the 555 notebook that Bernard got his children to record their spending, there is a column called “Need or Want”. For everything that they spent on, they had to categorise it as a need or want.

“This forces them to think: Do I really need this thing.”

An example of how Bernard helped his children keep track of their needs and wants. Screengrab from Salt&Light Family Night.

Samuel practises the same thing with his children. For example, if they want to buy a pen, he will ask them if it is a need or a want.

“It it’s a want, you will have to use your own money. If it is a need, I will buy it for you. You buy the pen and pass me the receipt and I will give you the money for it.”

6. Teach co-payment

Asher is hoping to learn to play the bass guitar. So, he is saving up to co-pay for the lessons.

“By asking them to pay for the present, the present will be more meaningful.”

Explained his father, Samuel: “This is to encourage him to have buy-in and help him appreciate the lessons a bit more.”

The co-payment scheme applies to birthday presents for friends as well. When he is invited to a party, Asher uses money from his special fund to pay for the gifts.

“Or else we will be the ones who keep buying the present and they don’t feel anything,” said Samuel.

“By asking them to pay for the present, I was hoping that they will know which friends’ parties they really want to go to and the present will be more meaningful.”

7. Work the system

Said Bernard: “I taught my children that there is money in the system. If you apply yourself, there are things like awards, bursaries and scholarships.”

His children took his advice and got scholarships.

Samuel has a system of rewards for his children.

“They are still quite young. So they are encouraged by rewards. For example, when they finish memorising a Bible verse, they earn a star. Every 10 stars, they can get to redeem S$15 that is added to their account as an extra.”

8. Do as I do

Klaudia models sound money management and values for her two sons. She told of a time when they went to a church camp in Malaysia. Her children were somersaulting from one bed to another and broke a hotel lamp.

Klaudia Yeo modelled honesty and prudence to her sons.

When they checked out, she reported the breakage and paid for the damage.

Years later, when her sons were teenagers, they returned to the same hotel for another church camp and her sons recalled the incident.

“My younger son told me, ‘That’s when I learnt about honesty.’ I didn’t know that I had taught them honesty in an indirect way, that if you did something wrong, you own up and pay for it.”

Klaudia is also mindful about modelling simple living. She is frugal about how she spends money.

“For me, a car is just a functional vehicle. As long as it can bring me from A to B safely, that serves my purpose. My boys see it and my kids pick up prudence.”

This report is Part 1 of the Salt&Light Family Night episode on how to teach children to manage money God’s way. Look out for Part 2 of the report next week.

A full recording of this episode will be available next week. You can watch past episodes of Salt&Light Family Night on our YouTube channel here.

RELATED STORIES:

“Do you know how much eggs cost?” How to teach children the value of money God’s way

We are an independent, non-profit organisation that relies on the generosity of our readers, such as yourself, to continue serving the kingdom. Every dollar donated goes directly back into our editorial coverage.

Would you consider partnering with us in our kingdom work by supporting us financially, either as a one-off donation, or a recurring pledge?

Support Salt&Light