Churches keeping up with the times through online giving

by Tan Huey Ying // June 16, 2020, 6:47 pm

It may have taken time for church members to adjust to online giving amid the flurry of changes related to COVID-19. But now churches are not far behind the curve in terms of digital payment, according to a poll of eight churches. Photo by Rupixen on Unsplash

With churches closed and unlikely to resume worship services even in Phase 2 of Singapore’s re-opening, digital payment options for tithes and offerings are turning out to be essential cogs in church operations.

Tithing and offering incomes fell across the board between March and April this year, according to a poll conducted by Salt&Light.

The size of the drop ranged between 8% and 40% in March and April. But for most, giving levels have since normalised to pre-COVID levels in May.

It has taken time to change giving habits of church members.

The eight churches Salt&Light spoke to had congregation sizes ranging from 200 to over 6,000. Each church had already instituted online giving methods to varying degrees.

Traditionally collected through physical offering bags, tithes and offerings are an inherent and universal aspect of church services regardless of denomination. For some churches, physical collections ceased as early as February when DORSCON Orange was announced and they suspended their physical weekend services. On March 24, all church services were suspended in line with government advisories.

Singular income

As religious bodies, most churches are almost-solely reliant on this source of income to cover operating costs that range from rental to staff salaries and ministry expenses. Few churches are able to develop alternative income sources apart from members’ giving.

This church also saw the largest income drop of close to 40%, with just over two months of cash reserves.

Salt&Light found that majority of the churches polled had at least six months of cash reserves, Which means that the temporary drop in income was worrying, but not critical.

Two smaller churches, however, were in precarious positions.

One church, which is about 300 strong, keeps only about one month’s worth of reserves. Giving by members fell by about a third since services were cancelled. However, the church is still financially viable as it doesn’t have rental expenses. It also has a small number of staff.

Some of the more senior members of the congregation have pledged their tithes when the church is able to reopen, explained the senior pastor. Some of them are less tech savvy or don’t have anyone to teach them to use online avenues to tithe. Others simply prefer giving cash.

The other is a smaller church of about 200. It only had just over two months of reserves. This church also saw the largest income drop of close to 40%.

When Salt&Light first spoke to its senior pastor in mid-April, they were left with only one month’s worth of operating expenses that included rental for its premises that no one could use.

A temporary dip?

However, the situation has since improved significantly, noted the senior pastor.

The church leadership recieved some contributions through personal contacts. Their landlord waived rental for two months. And giving in the month of May exceeded pre-COVID levels by 10%, even when the Circuit Breaker was extended.

Pre-COVID, online giving in this church made up only a fifth of each month’s income.

The senior pastor told Salt&Light that he thinks it has taken his members some time to adjust and move to online giving amidst the flurry of changes related to COVID-19. Barely a week after church services were put on hold, workplace and school closures were announced in April.

Few churches have alternative income sources apart from tithes

This theory was also supported by the larger churches.

The finance manager of a church with more than 6,000 members shared that when their church had moved towards online payments several years ago, it had taken them time to “change habits” – especially amongst older congregants.

This church experienced a 19% dip from March in April. However, the change was not significant as they saw a similar drop in during the same period last year. The church usually notices a spike in giving every March, which coincides with bonus season for most salaried employees.

Their earlier move to online giving prepared members in advance and cushioned the impact of the cessation of physical tithing .

This finding was similar to other churches which also had long-established online payment systems in place.

Tech help

However, help has been forthcoming for churches which have only just adopted online payment methods.

Pre-COVID, online giving in one church made up only a fifth of each month’s income.

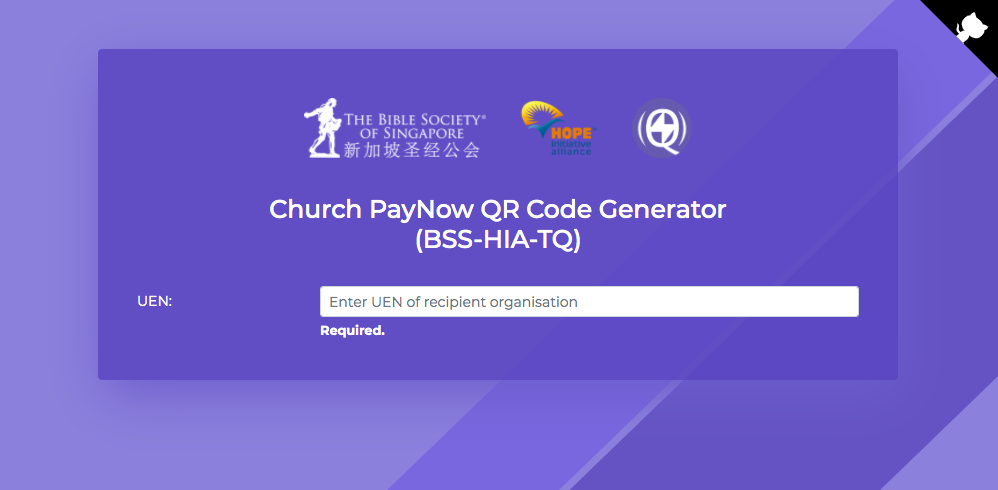

ThunderQuote, an SME specialising in IT solutions, has created an open-source QR code generator to ease the operational aspects of this move. It is the same company which launched Streams Of Life, a one-stop resource to help church leaders take their services online, in February.

The government’s recent push to get small businesses on digital payment platforms got its CEO Kevin Ng thinking. He realised that churches would face similar problems with tithes and offerings and set out to facilitate this process.

The end product: A customisable QR code generator, which churches could use for free. (A QR code is similar to the images placed outside malls and shops to speed up check-ins.)

This would simplify online giving for users, who only need to scan the code instead of having to key in various details. More importantly, it also reduced the work required by operations staff.

So the QR code generator became the perfect solution for a 1,300-member church which rolled out online payment avenues in January this year. Pre-COVID, the church used to make four collections at each of its four weekly worship services.

Apportioning funds used to a problem. Members often left out transaction references that would help the office allocate the funds correctly. It was very troublesome, the church operations manager told Salt&Light, especially with the increase in the number of lump-sum contributions.

They resolved the issue by creating 16 separate QR codes (four per congregation).

Amidst the changes however, churches remain sensitive to members’ who are unwilling or unable to give online.

Pastors told Salt&Light that this was understandable. Several are assuring anxious members that they will be able to tithe in person when services resume.

Shoring defenses

While the drop in income for churches seems to have been temporary, the impending economic recession is still a concern. Larger churches that Salt&Light spoke to are preparing for the longer term effects to kick in during the second half of the year.

One church, which has over 5,000 members meeting in separate locations, has frozen hiring and is holding off on large expenses. The other large church of over 6,000 members has conducted a budget review and have forecasted a lower income. However, they are taking a wait-and-see approach towards implementing cost-cutting measures.

Digital fund-raising is the next challenge that the Church must give consideration to.

Ministry expenses have naturally dropped due to a lack of activities. But most churches are cognisant of increased financial need in the society and amongst members, especially non-Singaporeans who did not qualify for governmental assistance in terms of Jobs Support Scheme or cash payouts. Leaders whom Salt&Light spoke to have not discounted the role of fundraising for such causes. But highlight that they cannot be tone-deaf and insensitive to other members who may be going through financial difficulties.

Ng believes that digital fund-raising is the next challenge that the Church must give consideration to eventually as society settles into a new normal.

Churches have not been caught far behind the curve in the issue of digital payment. However, moving beyond the issue of self-sufficiency, preparations should be made at an organisational level for Christians in Singapore to fulfil our calling as a channel of God’s love and His light unto our nation.

We are an independent, non-profit organisation that relies on the generosity of our readers, such as yourself, to continue serving the kingdom. Every dollar donated goes directly back into our editorial coverage.

Would you consider partnering with us in our kingdom work by supporting us financially, either as a one-off donation, or a recurring pledge?

Support Salt&Light